- [질문]

- 미답변

- 부동산

- 싱가폴부동산 회복이 시작되는 군요 (참고)

- 밝게맑게말야 (iandp)

- 질문 : 25건

- 질문마감률 : 4%

- 2017-06-19 15:00

- 답글 : 0

- 댓글 : 0

5,944

5,944 0

0

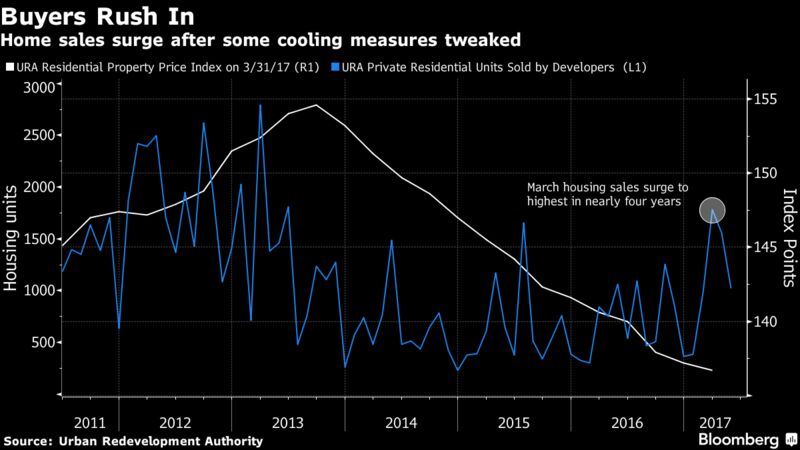

지난 번에 어떤 분이 3분기이후 싱가폴부동산 상승시작한다고 하더니,

이제 바닥은 확실히 친 건 분명하고 밑의 첨부한 블룸버그 기사들처럼

싱가폴부동산이 바닥을 치고 서서히 반등하는 군요. 부동산에 관심들 많으신것 같은 데 참고들 하세요.

그리고 밑의 기사들처럼 이제 콘도공실률이 점점 하락 할 거라고 하는 걸 보니

인구를 서서히 늘릴 것 같습니다.

근데 밑의 기사처럼 Queenstown Stirling Road는

왜 저렇게 싱가폴역사상 사상최대의 Land Bidding이 된건지...

무려 10억달러라니 와....

스트레이츠타임즈기사보면 1050per sqf에 사서

1200sqf 방3개 기준 2,000 per sq에 분

양 할 계획이랍니다. 마진율이 약 10%정도로 추정이라는 데

뭐야 완전 오차드와 똑같은 가격이군요.. 거기가 어떻게 개발되길래???

근데 West쪽 District 3/4/5에 콘테이너부두가 올연말 내년부터 옮겨가고

본격적으로 집중개발중이라더니 맞는 것 같군요.

이제부터 다음 2021년 선거때까지 점점 상승하겠죠

다음선거는 2021년이니 이제부터 반등시작하면 2018년- 2019년에 가파르게 상승

2020년 후반이면 다시 제한?? ㅎ

마지막 기사는 자꾸 짤려서 내용이 다 나오지 않는 군요. 링크:

https://www.bloomberg.com/news/articles/2017-06-15/singapore-land-hunger-revives-bloc-sales-amid-home-price-rebound

Singapore Land Gets Record S$1 Billion Bid From China Buyers

by-

Logan Property, Nanshan submit top bid for Stirling Road site

-

Price adds to signs housing market is rebounding from slump

A residential plot in Singapore may fetch a record price for a government land sale, with a Chinese consortium putting in the highest bid at S$1 billion ($718 million).

Logan Property (Singapore) Co. and Nanshan Group Singapore Co. submitted the highest bid in the Stirling Road land auction that closed Thursday, according to a statement from the Urban Redevelopment Authority. The winning bid will be decided once the offers have been evaluated.

The price would be equivalent to S$1,050 per square foot of gross floor area, translating into the highest absolute price paid for a residential plot, according to Cushman & Wakefield Inc. The plot can house about 1,110 units, according to URA estimates.

“It’s the first time for a pure residential site to cross the S$1 billion mark,” said Christine Li, director of research for Singapore at Cushman & Wakefield. “The participation from 13 local and foreign developers shows the sheer amount of liquidity in the market as S$11 billion is going after a plum site.”

Hunger for Singapore land is adding to signs the city’s housing market is making a comeback after three years of declining prices. With new home sales surging after an easing of property restrictions in March, developers are becoming more aggressive in bidding at land auctions. On average, they’ve paid a 29 percent premium, the highest level in at least five years, according to Cushman & Wakefield.

“The strong bid and healthy local participation reflects developers’ optimism on Singapore residential property,” UOB Kay Hian Pte. analysts Vikrant Pandey and Derek Chang said in a note. They expect housing prices to move in line with GDP growth of 2 percent to 4 percent in 2018, after bottoming out this year at about 15 percent to 20 percent below the peak set in the third quarter of 2013.

Top Bid

The top bid came from a joint venture between Logan Property Holdings Co., a Hong Kong-listed developer which has developments in Shenzhen and the Pearl River Delta region, and China’s Nanshan Group. Nanshan has been active in Singapore’s government land auctions, participating in eight of 11 tenders in the past 12 months, according to Cushman & Wakefield.

“The winning bid is an anticipatory one -- looking forward to a possible tweak of measures in the pipeline or some form of market recovery,” said Desmond Sim, head of research for Singapore and South East Asia at CBRE Group Inc.

Logan Property shares rose 2.2 percent as of 10:36 a.m. in Hong Kong, taking this year’s gain to 45 percent.

MCL Land (Everbright) Pte. was the second-highest bidder at S$925.7 million.

Singapore Property

Stocks Are on a Roll

by-

Five of top 10 stocks this year are real estate companies

-

JPMorgan continues to see upside in property developer shares

Singapore property stocks are set for their best annual performance in five years, and strategists believe the rally is far from over.

With an expected pickup in real estate following the easing of housing curbs, developers are expected to be the bright spot in Singapore equities as gains in the city-state’s stocks may be limited for the rest of the year.

“The residential property market has seen a marked improvement in sentiment,” said Desmond Loh at JPMorgan Asset Management, who helps manage the second-best performing Singapore fund this year. Developers that have started buying land for new projects stand to benefit, he said, adding that vacancy rates are expected to decline over the next few years.

The city-state’s government sparked renewed interest in the Singapore real estate market after it rolled back some curbs in March following a 3 1/2-year slump in home prices, the longest stretch of declines since the data was first published in 1975. In the same month, housing sales surged to the highest in nearly four years as developers sold more than twice the number of homes compared with the previous year, government data showed.

Property stocks including City Developments Ltd. and UOL Group Ltd. are already driving gains in Singapore stocks so far this year, with developers and property trusts making up half of the 10 best-performing stocks on the Straits Times Index. The city-state’s benchmark measure has climbed 12 percent this year, while the gauge tracking 42 Singapore real estate stocks has jumped 16 percent, heading for its biggest annual gain since 2012.

City Developments rose as much as 1.4 percent in Singapore on Monday, its first daily gain in six days. UOL Group advanced as much as 0.9 percent while CapitaLand Ltd. climbed 0.8 percent.

“Prices are moving upwards again, albeit in a more gradual direction, market interest is more positive in terms of transactions,” said Andrew Gillan, head of equities for Asia excluding Japan at Janus Henderson Group, which has about $330.8 billion assets under management globally. “That’s going to bode relatively well for earnings,” he added, pointing to developers that have accumulate land at "reasonable" costs.

Government land sales are drawing investor interest. A residential plot last month fetched a record price in a government sale, with a Chinese consortium bidding S$1 billion ($723 million). Other developers are adding land by buying up existing apartment buildings for redevelopment in so-called en-bloc sales. Four of these deals -- where a group of owners band together to sell entire apartment blocks at a hefty premium -- have been struck this year, with a combined value of S$1.5 billion.

Still, the recovery in home sales hasn’t been consistent. Government data last week showed Singapore home sales fell 34 percent in May as fewer new projects were marketed. And a further increase in housing transactions may also prompt more curbs or slow the relaxation of them.

The risk is “if volume really start to pick up quite strongly, then we will see more measures from the Monetary Authority of Singapore,” said Mixo Das, Nomura’s Southeast Asian equity strategist, referring to the city-state’s central bank. “That’s something I can’t rule out, it’s certainly a possibility.”

Read more: a QuickTake on how Singapore cooled its property market

That may also add to the headwinds limiting gains in the overall Singapore market. The Straits Times Index’s valuation is “looking a bit high” versus historical levels and some of its regional peers, which would cap further increases this year at 3 percent to 5 percent at best, said Carmen Lee, head of research at Oversea-Chinese Banking Corp. The gauge is trading at 14.7 times expected earnings, compared with 13.3 times at the start of the year.

While property stocks aren’t as cheap as they were six to nine months ago, most are still trading at a discount to their book value and will outperform the overall market, she said. The Singapore property stock index is trading at a price-to-book value of 0.89, and last traded at par four years ago, according to data compiled by Bloomberg.

The optimism for home sales this year also comes as investor sentiment improved in the city-state on the back of a recovery in export demand that prompted the government to give an upbeat outlook on the economy in May, saying it will probably expand more than 2 percent this year.

“We’re in a recovery phase at this point,” said Sean Gardiner, an equity strategist at Morgan Stanley in Singapore, said by phone. “There are a number of macro prudential measures that are still weighing on the real estate market but we are definitely up from the bottom we saw early last year.”

Here's Another Sign Singapore's Housing Market Is Recovering

by-

Four deals struck already this year as sellers band together

-

Redevelopment deals on track for busiest year since 2011

A crane standing at the construction site is silhouetted at dusk in Singapore.

Photographer: SeongJoon Cho/BloombergChalk up another sign Singapore’s housing market is recovering: redevelopment deals are back.

After slowing to a trickle the past three years as housing prices fell, four redevelopment deals -- where a group of owners band together to sell entire apartment blocks at a hefty premium -- have been struck already this year, with a combined value of S$1.5 billion ($1.1 billion). The process, also known as “en-bloc” sales, allows developers to knock down and rebuild in a city where new residential land sales are tightly controlled by the government.

The renewed hunger for land comes as home sales climb after some

꼭 필요한 질문, 정성스런 답변 부탁드립니다!

알림 (2)

알림 (2)

쪽지 (0)

쪽지 (0) 뉴스레터 (0)

뉴스레터 (0) 로그인

로그인 추천(0)

추천(0)

글작성

글작성

조회수 : 9,525

조회수 : 9,525

1

1